what is a closed tax lot report

Short- or long-term status of the sale. 4 I had reached out to Payroll for clarification about reporting compensation from Lot 1 and Lot 2 on my paychecks and also on w-2 Box 1 but NOT reporting anything for Lot 3.

Introducing Ihomereport Investing Real Estate Tips How To Know

The business is closed and you are ready to.

. The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position. In box 1a enter a brief description of the transaction for example 5000 short sale of 100 shares of ABC stock not closed. Leave the other numbered boxes blank.

This was NOT mentioned against Lot3. Manually match specific lots to trades using the Specific Lot matching method. Report on Form 1099-B the relevant information about the security sold to open the short sale with the exceptions described in the following paragraphs.

You can also view whether your positions are categorized as long term or short term. FIFO First In First Out LIFO Last In First Out HIFO Highest In First Out LOFO Lowest Cost First Out HCST Highest Cost Short Term HCLT Highest Cost Long Term LCLT Lowest Cost Long Term and LCST Lowest. File a final Form 1099-B for the year the short sale is closed as described above but do not include the 2021 tax withheld on that Form 1099-B.

What is a closed tax lot Report. In box 1b report the acquisition date of the security delivered to close the short sale. Enter the date the business closed if known otherwise enter 1231 of the tax year you are preparing.

With closed tax lots you can track the following information for each security you currently own. Tax treatment of covered calls. It mentioned that Tax lot closed is a specified lot.

There are eight available tax lot relief methods from which clients can choose as their standing tax lot relief method. Gain or loss amount. Frequently Asked Questions and more.

In box 1a report the quantity of the security delivered to close the short sale. Unclaimed property is funds andor property that are in the possession of a holder that are owned by or owed to someone else. Since it is not a tax there is no statute of limitations for unclaimed property unless a state enacts.

Other names for unclaimed property are escheat or abandoned property. In turn it helps identify the cost basis and holding period of the asset sold. Your capital gain or loss is equal to the difference between the assets cost basis and the sales price of the closing transaction.

Income or loss is recognized when the call is closed either by expiring worthless by being closed with a closing purchase transaction or by being assigned. A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and you enter a trade to sell only part of the position. If available gainloss information is provided for closed lots that require 1099-B reporting.

A list of all tax forms and reports for the current tax year with links to the actual PDF forms. View year-to-date profit and loss data by symbol. With closed tax lots you can track the following information for each security you currently own.

The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021. Make changes and save them until 830 PM ET on any given trading day. It shows wash sale information and any adjustments to cost basis when applicable.

Our Tax Reporting web pages include a wealth of important tax-related information including. As a result of IRS cost-basis reporting regulations that took effect at the beginning of 2011 the adjusted cost basis for some of your tax lots may be reported to the IRS while the adjusted cost basis for other tax lots will not depending on the. The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2.

Tax reporting for wash sales. These methods are as follows. Unclaimed property is not a tax.

Scroll down to the section Sale of Asset enter the sales price or if it was not sold enter -1 The above steps causes those assets highlighted to appear on form 4797 and boom bada bing. Not sure if that matters but thought of mentioning it. Information for US Canadian and other non-US persons and entities.

A tax-lot relief method is used to determine which lots of a security are liquidated first in a given sales transaction. A tax lot is the number of shares in the same security acquired at the same time. Gainloss information is not provided for transactions that Fidelity is not required to report on Form 1099-B such as transfers to other accounts.

Tax Optimizer is integrated with your trading app. Gain or loss amount. In general each tax lot will have a different purchase price.

According to Taxes and Investing the money received from selling a covered call is not included in income at the time the call is sold. In Trader Workstation TWS use the right-click menu from a position and select Change Tax Lots. We are required by law to track and maintain this information and to report the cost basis and.

Every time you sell shares a closed tax lot is created to track the date and price of your sale. Every time you sell shares a closed tax lot is created to track the date and price of your sale. Short- or long-term status of the sale.

Pet Grooming Business Planner Printable Pet Groomer Pet Etsy In 2022 Pet Grooming Business Business Planner Printable Planner

Non Profit Treasurer Report Template

Tax Client Information Sheet Template Google Docs Word Apple Pages Pdf Template Net

The Big Change With The Removal Of Tax Liens And Judgments Continental Credit Credit Repair Letters Credit Repair Business Credit Score

Notes On Tax Planning Services

5 Investment Tax Mistakes To Avoid Tax Mistakes Investing Tax Preparation

Company Analysis Report Template Sample

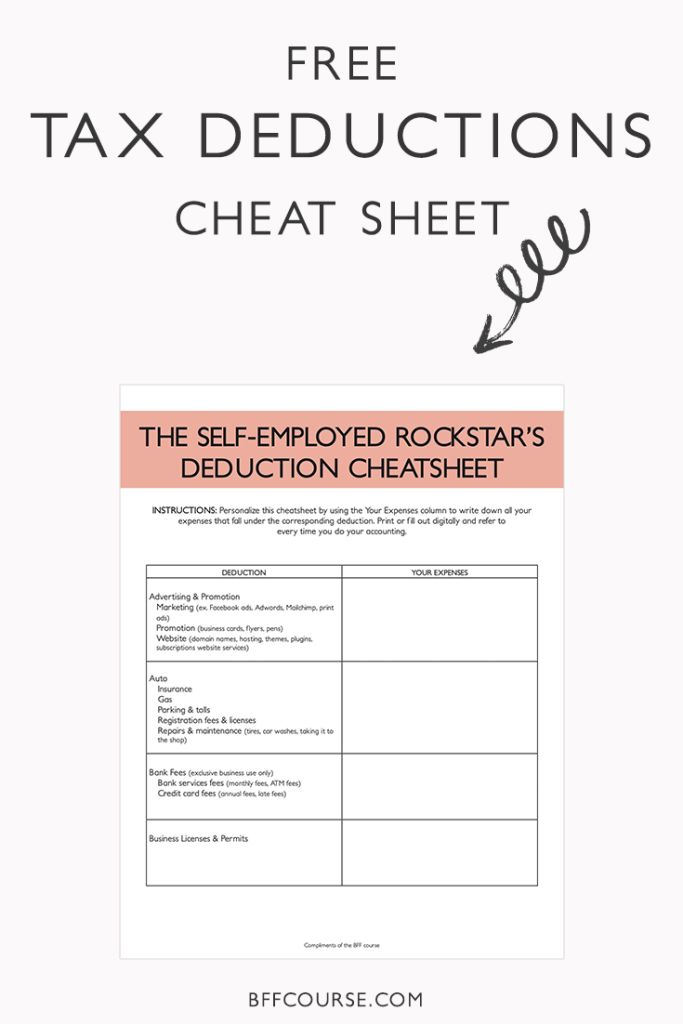

The Epic Cheatsheet To Deductions For The Self Employed

Rental Security Deposit Refund Form

Do You Have A Home Based Business Did You Know That You Can Deduct Car Expenses Home Based Business Tax Deductions Successful Home Business Business Tax

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

80 Other Ways To Say In Addition In Addition Synonym 7esl

Definition What Is A Tax Return

How To Use A Profit Loss Report To Increase Your Income Bookkeeping Business Small Business Bookkeeping Business Tax

If You Found Any Images Copyrighted To Yours Please Contact Us And We Will Remove It We Don T I Profit And Loss Statement Statement Template Invoice Template

4 Steps To View The Shopify Finances Summary Page On Shopify